The Finance Ministry said that when there is a high annual budget deficit, it is not possible to print money to cover it, so the government has no choice but to borrow from the local market.

Finance Ministry Secretary Mahinda Siriwardena told the Daily News while replying to a query regarding the allegations made by some that after the election of President Anura Kumara Dissanayake, a large amount of loan money was taken from the local and foreign markets.

Recalling the history of various governments facing high budget deficits annually, the Finance Secretary pointed out that in order to be freed from the debt burden, the debt restructuring process must be carried out successfully.

He said that tax revenues should be collected in such a way as not to burden the people as much as possible in creating a financial situation that the government can afford.

The Finance Secretary also said that although some people have some personal agendas and criticisms about the government’s domestic debt stock, it is his opinion that a lot of effort will have to be put in to manage it as a government.

Despite what the critics say, one must also consider how to manage it, he said.

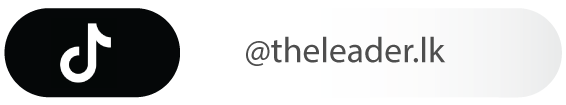

Between 2020 and 2022, government debt increased significantly, as evidenced by higher annual budget deficits. Much of this borrowing was done directly by the Central Bank through budget deficit financing (simply known as money printing). However, this is an inflationary practice, as evident with inflation rising to a record high of around 70 percent in 2022.

From the year 2023, the government has removed the Central Bank from providing loans to finance the budget deficit, and the necessary borrowing was to be done entirely from the domestic market. This has come at a cost as interest rates rise as borrowing rises. This increase in interest rates in 2023 contributed to the higher interest cost incurred by the government. In fact, in 2023, interest costs were about 80 percent of government revenue.

However, by now, interest rates have fallen back to single digit levels (yields on Treasury Bills) in response to the government’s effective fiscal and monetary management. Debt burdens are expected to ease further as the economy grows and real interest rates remain low.

The government is in the process of restructuring its debt, which will further ease the debt servicing burden. Therefore, it is essential to continue this process. Under the debt restructuring strategy, unpaid loans and interest during the period of moratorium will be gradually distributed over the coming periods, thereby easing the burden on the fiscal process.

Constraints on debt restructuring continue as a large proportion of domestic debt is held by domestic institutions such as state-owned banks and pension funds such as the Employees’ Provident Fund. The Domestic Debt Optimisation Operation implemented in 2023 helped ease the burden on public finances to a large extent. Further restructuring of debt held by domestic institutions could have significant economic and social costs.

It should be clear that deficit financing and debt is a complex and delicate process with multiple factors to consider. Using a simple, flawed analysis of a single number to explain complex topics is not helpful. Such simplistic analyses have been used in the past to mislead the public, and this is indeed one of the reasons for the deep economic crisis Sri Lanka has faced. “It is important to avoid making the same mistakes again and to ensure that our judgement is guided by professional analysis and evidence,” the Finance Secretary said.